Mention the word body corporate and most people immediately think of levies.

I’m convinced it’s the one thing that everyone knows about body corporate’s that’s actually correct. Every body corporate does issue levies.

What amount those levies are is vastly different from building to building.

I’ve seen levies per lot as low as $55 per year and as high as $25,000.

Body corporate levies are a very individual thing. And that’s because different buildings have different facilities, different levels of repair, even differences in the make up of the residents, which will all effect how much the levies for a building are.

The Budget

Every body corporate has a budget.

People have budgets or guidelines for their spending but in the world of body corporate’s it’s not a budget, its “The Budget”.

It’s important. In a lot of ways it’s the bible.

Once the budget is set every financial decision made by the body corporate in the next financial year will be considered in terms of whether or not that expenditure is factored into the budget.

The key reason for that is that the budget is the body corporate levies for the year.

The process

Every year the Committee sit down to consider the body corporate’s needs. They consider everything (or at least they should; committees are made up of people, some who’re good with money, and some who aren’t) from costs to run the building like electricity and cleaning, through bank fees, management costs and any ongoing issues.

That amount is totalled up and that becomes the Administrative Fund Budget.

Most buildings will have some form of Sinking Fund Forecast that projects the future capital cost of the building. The Sinking Fund Forecast is considered along with any capital unscheduled outlay the committee wants to address.

That amount is totalled up and becomes the Sinking Fund Budget.

The budgets are divided by the aggregate lot entitlement and that becomes the levy issue.

The budgets and levy issues will be put to the owners for vote at the AGM. Once approved the levies are set for the next financial year.

How to calculate body corporate levies

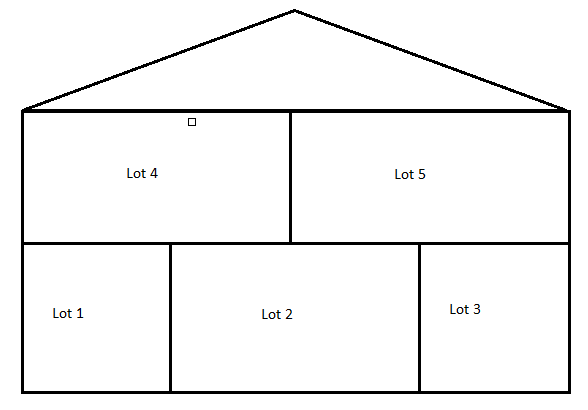

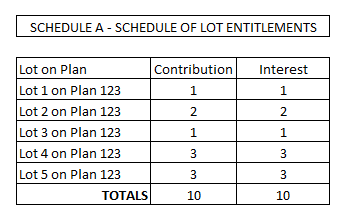

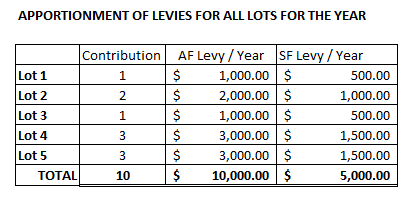

Say we have this body corporate with lot entitlements like this.

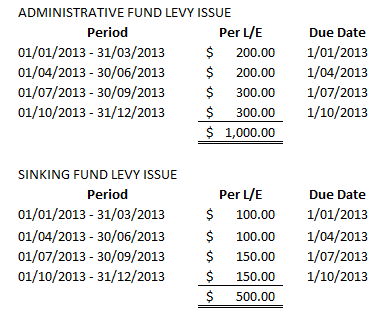

The committee have forecast administrative fund budgeted costs for the year of $10,000 and the sinking fund budgeted costs for the year of $5,000. The body corporate wants to collect those costs evenly over the year.

The levy issue as put to owners at the AGM will look like this:

The total administrative fund budget of $10,000 is divided by the total contribution lot entitlements, 10, which gives an amount of $1,000 per lot entitlement to be collected.

The same calculation is done with the sinking fund budget – $5,000 / 10 – giving an amount of $500 per contribution lot entitlement to be collected.

My example body corporate here is collecting levies quarterly and there is not discount.

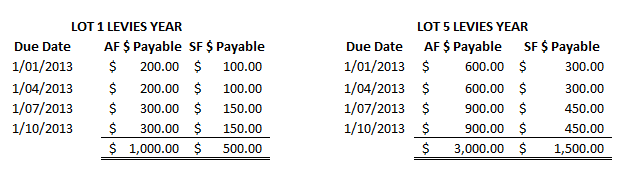

To calculate the levies payable the amount for each levy issue is multiplied by the lot entitlement of each lot. Lots 1 and 3 have lot entitlements of 1, so they pay the amounts as set out in the levy issue. Lot 2 pays double, and lots 4 and 5 three times.

The figures above show levies payable for lot 1 and lot 5 for each of the four periods throughout the year.

The figures below show how much each lot will pay in total for the year.

Conclusion

Above is a very simplistic example of how levies are calculated; I’ve not taken into account discounts, previous fund balances, deficits or surpluses.

In reality calculation of the budget is a complex and time consuming process, particularly when some body corporate budgets can run into many millions of dollars.

It’s no wonder then that most body corporate managers employ Accountants and bookkeepers to manage finances.